<Back to Index>

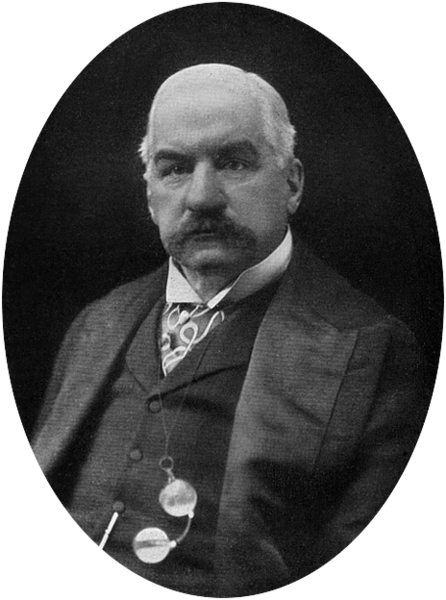

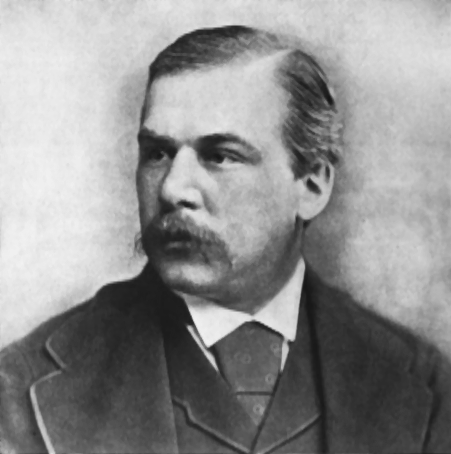

- Financier John Pierpont Morgan, 1837

- Composer Harald Sigurd Johan Sæverud, 1897

- Prime Minister of France Maurice Rouvier, 1842

PAGE SPONSOR

John Pierpont Morgan (April 17, 1837 – March 31, 1913) was an American financier, banker and art collector who dominated corporate finance and industrial consolidation during his time. In 1892 Morgan arranged the merger of Edison General Electric and Thomson - Houston Electric Company to form General Electric. After financing the creation of the Federal Steel Company he merged in 1901 with the Carnegie Steel Company and several other steel and iron businesses, including Consolidated Steel and Wire Company owned by William Edenborn, to form the United States Steel Corporation.

Morgan died in Rome, Italy, in 1913 at the age of 75, leaving his fortune and business to his son, John Pierpont "Jack" Morgan, Jr., and bequeathing his mansion and large book collections to The Morgan Library & Museum in New York.

At

the height of Morgan's career during the early 1900s, he and his

partners had financial investments in many large corporations and was

accused by critics of controlling the nation's high finance. He

directed the banking coalition that stopped the Panic of 1907. He was the leading financier of the Progressive Era,

and his dedication to efficiency and modernization helped transform

American business. Morgan redefined conservatism in terms of financial

prowess coupled with strong commitments to religion and high culture.

J.P. Morgan was born and raised in Hartford, Connecticut to Junius Spencer Morgan (1813 – 1890) and Juliet Pierpont (1816 – 1884) of Boston, Massachusetts. Pierpont, as he preferred to be known, had a varied education due in part to interference by his father, Junius. In the fall of 1848, Pierpont transferred to the Hartford Public School and then to the Episcopal Academy in Cheshire, Connecticut (now called Cheshire Academy), boarding with the principal. In September 1851, Morgan passed the entrance exam for the English High School of Boston, a school specializing in mathematics to prepare young men for careers in commerce.

In the spring of 1852, illness that was to become more common as his life progressed struck; rheumatic fever left him in so much pain that he could not walk. Junius sent Pierpont to the Azores (Portuguese islands in the Atlantic) in order for him to recover. After convalescing for almost a year, Pierpont returned to the English High School in Boston to resume his studies. After graduating, his father sent him to Bellerive, a school near the Swiss village of Vevey. When Morgan had attained fluency in French, his father sent him to the University of Göttingen in order to improve his German. Attaining a passable level of German within six months and also a degree in art history, Morgan traveled back to London via Wiesbaden, with his education complete.

Morgan went into banking in 1857 at his father's London branch, moving to New York City in 1858 where he worked at the banking house of Duncan, Sherman & Company, the American representatives of George Peabody & Company. From 1860 to 1864, as J. Pierpont Morgan & Company, he acted as agent in New York for his father's firm. By 1864 – 1872, he was a member of the firm of Dabney, Morgan, and Company. In 1871, he partnered with the Drexels of Philadelphia to form the New York firm of Drexel, Morgan & Company. Anthony J. Drexel became Pierpont's mentor at the request of Junius Morgan.

In the early days of the

American Civil War Morgan financed a scheme, known as the "Hall Carbine Affair", that purchased 5,000 dangerously defective Hall's Carbines being

liquidated by the U.S. Government at a cost of $3.50 each. The rifles

were later resold to the government as new carbines lacking the safety

flaw at a cost of $22. The audacity of the scheme included not only the

$92,426 loss by the government and the selling of weapons known to maim

their operators to an army in need of firearms, but the guns were also

sold prior to ownership, thus the guns were paid for with money from

their sale back to the government. Some authors have suggested that

Morgan was somehow unaware that the guns were being resold, however

scholarly opinion regards this as "implausible".

Morgan during the American Civil War was required by law to either serve himself or provide a substitute; he paid $1000 for a substitute while he worked to finance the Union war effort.

After the 1893 death of

Anthony Drexel, the firm was rechristened "J. P. Morgan & Company" in 1895, and retained close ties with Drexel & Company of Philadelphia, Morgan, Harjes & Company of Paris, and J.S. Morgan & Company (after 1910 Morgan, Grenfell & Company), of London. Fifteen years later also marked his creation of the Chase Manhattan Bank.

By 1900, it was one of the most powerful banking houses of the world,

carrying through many deals especially reorganizations and

consolidations. Morgan had many partners over the years, such as George W. Perkins, but remained firmly in charge.

Morgan's ascent to power was accompanied by dynamic financial battles. He wrested control of the Albany and Susquehanna Railroad from Jay Gould and Jim Fisk in 1869. He led the syndicate that broke the government financing privileges of Jay Cooke, and soon became deeply involved in developing and financing a railroad empire by reorganizations and consolidations in all parts of the United States. He raised large sums in Europe, but instead of only handling the funds, he helped the railroads reorganize and achieve greater efficiencies. In 1885, he reorganized the New York, West Shore & Buffalo Railroad, leasing it to the New York Central. In 1886, he reorganized the Philadelphia & Reading, and in 1888 the Chesapeake & Ohio. He was heavily involved with railroad tycoon James J. Hill and the Great Northern Railway. After Congress passed the Interstate Commerce Act in 1887, Morgan set up conferences in 1889 and 1890 that brought together railroad presidents in order to help the industry follow the new laws and write agreements for the maintenance of "public, reasonable, uniform and stable rates." The conferences were the first of their kind, and by creating a community of interest among competing lines paved the way for the great consolidations of the early 20th century. Morgan's process of taking over troubled businesses to reorganize them was known as "Morganization". Morgan reorganized business structures and management in order to return them to profitability. His reputation as a banker and financier also helped bring interest from investors to the businesses he took over.

In 1896

Adolph Simon Ochs,

who owned the Chattanooga Times, secured financing from

Morgan to purchase the financially struggling New York

Times. It

became the standard for American journalism by cutting prices,

investing in news gathering, and insisting on the highest quality of

writing and reporting.

In 1895, at the depths of the Panic of 1893, the Federal Treasury was nearly out of gold. President Grover Cleveland arranged

for Morgan to create a private syndicate on Wall Street to supply the

U.S. Treasury with $6.5 million in gold, to float a bond issue

that restored the treasury surplus of $7 million. The episode

saved the Treasury but hurt Cleveland with the agrarian wing of his Democratic party and became an issue in the election of 1896, when banks came under withering attack from William Jennings Bryan. Morgan and Wall Street bankers donated heavily to Republican William McKinley, who was elected in 1896 and reelected in 1900.

After the death of his father in 1890, Morgan took control of J. S. Morgan & Co. which was re-named Morgan, Grenfell & Company in 1910. Morgan began talks with Charles M. Schwab, president of Carnegie Co., and businessman Andrew Carnegie in 1900. The goal was to buy out Carnegie's steel business and merge it with several other steel, coal, mining and shipping firms to create the United States Steel Corporation. His goal was almost completed in late 1900 while negotiating a deal with Robert D. Tobin and Theodore Price III, but was then retracted immediately. In 1901 U.S. Steel was as the first billion dollar company in the world with an authorized capitalization of $1.2 billion — much larger than any other industrial firm, and comparable in size to the largest railroads.

U.S. Steel aimed to achieve greater economies of scale, reduce transportation and resource costs, expand product lines, and improve distribution. It was also planned to allow the United States to compete globally with Britain and Germany. U.S. Steel's size was claimed by Charles M. Schwab and others to allow the company to pursue distant international markets - globalization. U.S. Steel was regarded as a monopoly by critics, as the business was attempting to dominate not only steel but also the construction of bridges, ships, railroad cars and rails, wire, nails, and a host of other products. With U.S. Steel, Morgan had captured two - thirds of the steel market, and Schwab was confident that the company would soon hold a 75 percent market share. However, after 1901 the businesses' market share dropped. Schwab resigned from U.S. Steel in 1903 to form Bethlehem Steel, which became the second largest U.S. producer on the strength of such innovations as the wide flange "H" beam — precursor to the I-beam — widely used in construction.

Labor policy was a contentious issue. U.S. Steel was non - union and experienced steel producers, led by Schwab, wanted to keep it that way with aggressive tactics to identify and root out trouble makers. The lawyers and bankers who had organized the merger, notably Morgan and the CEO Elbert "Judge" Gary were more concerned with long run profits, stability, good public relations, and avoiding trouble. The bankers' views generally prevailed, and the result was a paternalistic labor policy. U.S. Steel was finally unionized in the late 1930s.

The

Panic of 1907 was

a financial crisis that almost crippled the American economy. Major New

York banks were on the verge of bankruptcy and there was no mechanism

to rescue them until Morgan stepped in personally and took charge,

resolving the crisis. Treasury Secretary George B. Cortelyou earmarked

$35 million of federal money to quell the storm but had no easy way to

use it. Morgan now took personal charge, meeting with the nation's

leading financiers in his New York mansion; he forced them to devise a

plan to meet the crisis. James Stillman,

president of the National City Bank, also played a central role. Morgan

organized a team of bank and trust executives which redirected money

between banks, secured further international lines of credit, and

bought plummeting stocks of healthy corporations. A delicate political

issue arose regarding the brokerage firm of Moore and Schley, which was

deeply involved in a speculative pool in the stock of the Tennessee

Coal, Iron and Railroad Company. Moore and Schley had pledged over $6

million of the Tennessee Coal and Iron (TCI) stock for loans among the

Wall Street banks. The banks had called the loans, and the firm could

not pay. If Moore and Schley should fail, a hundred more failures would

follow and then all Wall Street might go to pieces. Morgan decided they

had to save Moore and Schley. TCI was one of the chief competitors of

U.S. Steel and it owned valuable iron and coal deposits. Morgan

controlled U.S. Steel and he decided it had to buy the TCI stock from

Moore and Schley. Judge Gary, head of US Steel, agreed, but would there

be antitrust implications that could cause grave trouble for US Steel,

which was already dominant in the steel industry. Morgan sent Gary to

see President Theodore Roosevelt,

who promised legal immunity for the deal. U.S. Steel thereupon paid $30

million for the TCI stock and Moore and Schley was saved. The

announcement had an immediate effect; by November 7, 1907, the panic

was over. Vowing to never let it happen again, and realizing that in a

future crisis there was not likely to be another Morgan, banking and

political leaders, led by Senator Nelson Aldrich devised a plan that became the Federal Reserve System in 1913. The crisis underscored the need for a powerful mechanism, and Morgan supported the move to create the Federal Reserve System.

While conservatives in the Progressive Era hailed Morgan for his civic responsibility, his strengthening of the national economy, and his devotion to the arts and religion, the left wing felt threatened by his enormous economic power.

Enemies of banking attacked Morgan for the terms of his loan of gold to the federal government in the 1895 crisis, for his financial resolution of the Panic of 1907, and for bringing on the financial ills of the New York, New Haven and Hartford Railroad. In December 1912, Morgan testified before the Pujo Committee, a subcommittee of the House Banking and Currency committee. The committee ultimately found that a cabal of financial leaders were abusing their public trust to consolidate control over many industries: the partners of J.P. Morgan & Co. along with the directors of First National and National City Bank controlled aggregate resources of $22.245 billion. Louis Brandeis, later a U.S. Supreme Court Justice, compared this sum to the value of all the property in the twenty - two states west of the Mississippi River.

Morgan did not always invest well, as failures with energy, subways and shipping demonstrated.

In 1900, Morgan financed inventor

Nikola Tesla and his Wardenclyffe Tower with

$150,000 for experiments in transmitting energy. However, in 1903, when

the tower structure was near completion, it was still not yet

functional due to last minute design changes that introduced an

unintentional defect. When Morgan wanted to know "Where can I put the

meter?" Tesla had no answer. By July 1904, Morgan (and the other

investors) finally decided they would not provide any additional

financing. Morgan also advised other investors to avoid the project.

In 1902, J. P. Morgan & Co. financed the formation of International Mercantile Marine Company, an Atlantic shipping combine which absorbed several major American and British lines. IMM a holding company that controlled subsidiary corporations that had their own operating subsidiaries. Morgan hoped to dominate transatlantic shipping through interlocking directorates and contractual arrangements with the railroads, but that proved impossible because of the unscheduled nature of sea transport, American antitrust legislation, and an agreement with the British government. One of IMM's subsidiaries was the White Star Line, which owned the "RMS Titanic". The ship's famous sinking in 1912, the year before Morgan's death, was a financial disaster for IMM, which was forced to apply for bankruptcy protection in 1915. Analysis of financial records shows that IMM was overleveraged and suffered from inadequate cash flow that caused it to default on bond interest payments. Saved by World War I, IMM eventually reemerged as the United States Lines, which itself went bankrupt in 1986. Morgan lost heavily on the deal.

After the death of his father in 1890, Morgan gained control of J. S. Morgan & Co (re-named Morgan, Grenfell & Company in 1910). Morgan began conversations with Charles M. Schwab, president of Carnegie Co., and businessman Andrew Carnegie in 1900 with the intention of buying Carnegie's business and several other steel and iron businesses to consolidate them to create the United States Steel Corporation. Carnegie agreed to sell the business to Morgan for $487 million. The deal was closed without lawyers and without a written contract. News of the industrial consolidation arrived to newspapers in mid January 1901. U.S. Steel was founded later that year and was the first billion dollar company in the world with an authorized capitalization of $1.4 billion.

Morgan was the founder of the

Metropolitan Club of New York and its president from 1891 to 1900. When his friend, Frank King, whom he had proposed, was black - balled by the Union Club because

he had done manual labor in his youth, Morgan resigned from the Union

Club, and then organized the Metropolitan Club. He donated the land on

5th Avenue and 60th Street at a cost of $125,000, and commanded

Stanford White, "Build me a club fit for gentlemen. Forget the

expense." Of course he invited King as a charter member.

Morgan was a lifelong member of the Episcopal Church, and by 1890 was one of its most influential leaders. In

1861, he married Amelia Sturges, a.k.a Mimi (1835 – 1862). After her

death the next year, he married Frances Louisa Tracy, known as Fanny

(1842 – 1924) on May 31, 1865. They had four children: John Pierpont Morgan (1867 – 1943), Louisa Pierpont Morgan (1866 – 1946) who married Herbert L. Satterlee, Juliet Pierpont Morgan (1870 – 1952), and William Pierson Hamilton (1869 – 1950), Anne Morgan (1873 – 1952). He

often had a tremendous physical effect on people; one man said that a

visit from Morgan left him feeling "as if a gale had blown through the

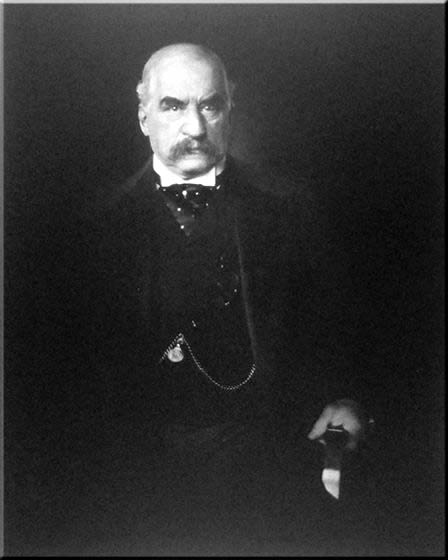

house." Morgan

was physically large with massive shoulders, piercing eyes and a purple

nose, because of a chronic skin disease, rosacea. His deformed nose was due to a disease called rhinophyma,

which can result from rosacea. As the deformity worsens, pits, nodules,

fissures, lobulations, and pedunculation contort the nose. This

condition inspired the crude taunt "Johnny Morgan's nasal organ has a

purple hue." Surgeons

could have shaved away the rhinophymous growth of sebaceous tissue

during Morgan's lifetime, but as a child Morgan suffered from infantile

seizures, and it is suspected that

he did not seek surgery for his nose because he feared the seizures

would return. His social and professional self - confidence were too well

established to be undermined by this affliction. It appeared as if he

dared people to meet him squarely and not shrink from the sight,

asserting the force of his character over the ugliness of his face. He

was known to dislike publicity and hated being photographed; as a

result of his self - consciousness of his rosacea, all of his

professional portraits were retouched. Morgan smoked dozens of cigars per day and favored large Havana cigars dubbed Hercules' Clubs by observers. His

house on Madison Avenue was the first electrically lit private

residence in New York. His interest in the new technology was a result of his financing Thomas Edison's Edison Electric Illuminating Company in 1878. It

was at 219 Madison avenue that a reception of 1000 people was held for

the marriage of Juliet Morgan and William Pierson Hamilton on April 12

1894, where they were gifted a favorite clock of J.P. Morgan. J. P.

Morgan also owned East Island in Glen Cove, New York, where he had a large summer house. An

avid yachtsman, Morgan owned several sizeable yachts. The well known

quote, "If you have to ask the price, you can't afford it" is

commonly attributed to Morgan in response to a question about the cost

of maintaining a yacht. Morgan was scheduled to travel on the maiden voyage of the RMS Titanic, but canceled at the last minute. White Star Line, Titanic's

operator, was part of Morgan's International Mercantile Marine Company,

and Morgan was to have his own private suite and promenade deck on the

ship. Morgan

died while traveling abroad on March 31, 1913, just shy of his 76th

birthday. He died in his sleep at the Grand Hotel in Rome, Italy. Flags

on Wall Street flew at half - staff; the stock market closed for two hours when his body passed through. At

the time of his death, he only held 19% of his own net worth, an estate

worth $68.3 million ($1.39 billion in today's dollars based

on CPI, or $25.2 billion based on 'relative share of GDP'), of which

about $30 million represented his share in the New York and

Philadelphia banks. The value of his art collection was estimated at

$50 million. His remains were interred in the Cedar Hill Cemetery in his birthplace of Hartford, Connecticut. His son, J. P. Morgan, Jr., inherited the banking business. The Cragston Dependencies, associated with his estate Cragston at Highlands, New York, was listed on the National Register of Historic Places in 1982.

Morgan was a notable collector of books, pictures, paintings, clocks and other art objects, many loaned or given to the

Metropolitan Museum of Art (of

which he was president and was a major force in its establishment), and

many housed in his London house and in his private library on 36th

Street, near Madison Avenue in New York City. His son, J. P. Morgan, Jr., made the Pierpont Morgan Library a public institution in 1924 as a memorial to his father and kept Belle da Costa Greene, his father's private librarian, as its first director. Morgan was painted by many artists including the Peruvian Carlos Baca - Flor and the Swiss - born American Adolfo Müller - Ury,

who also painted a double portrait of Morgan with his favorite

grandchild Mabel Satterlee that for some years stood on an easel in the

Satterlee mansion but has now disappeared. Morgan was a benefactor of the American Museum of Natural History, the Metropolitan Museum of Art, Groton School, Harvard University (especially its medical school), Trinity College, the Lying - in Hospital of the City of New York, and the New York trade schools. By

the turn of the century JP Morgan had become one of America's most

important collectors of gems and had assembled the most important gem

collection in the U.S. as well as of American gemstones (over 1000

pieces). Tiffany & Co. assembled his first collection under their Chief Gemologist George Frederick Kunz.

The collection was exhibited at the World's Fair in Paris in 1889. The

exhibit won two golden awards and drew the attention of important

scholars, lapidaries and the general public. George

Frederick Kunz then continued to build a second, even finer, collection

which was exhibited in Paris in 1900. Collections have been donated to

the American Museum of Natural History in

New York where they were known as the Morgan - Tiffany and the Morgan -

Bement collections. In 1911 Kunz named a newly found gem after his

biggest customer: morganite.

Morgan was also a patron to photographer Edward S. Curtis, offering Curtis $75,000 in 1906, for a series on the Native Americans. Curtis eventually published a 20 volume work entitled "The North American Indian." Curtis

went on to produce a motion picture In The Land Of The Head

Hunters (1914), which was later restored in 1974 and re-released

as In The Land Of The War Canoes. Curtis was also famous for a

1911 Magic Lantern slide show The Indian Picture Opera which used his photos and original musical compositions by composer Henry F. Gilbert.

His son,

J. P. Morgan, Jr. took over the business at his father's death, but was never as influential. As required by the 1933 Glass – Steagall Act, the "House of Morgan" became three entities: J.P. Morgan & Co., which later became Morgan Guaranty Trust; Morgan Stanley, an investment house; and Morgan Grenfell in London, an overseas securities house. The gemstone Morganite was named in his honor.