<Back to Index>

- Anthropologist Loren Eiseley, 1907

- Painter Bengt Karl Erik Lindström, 1925

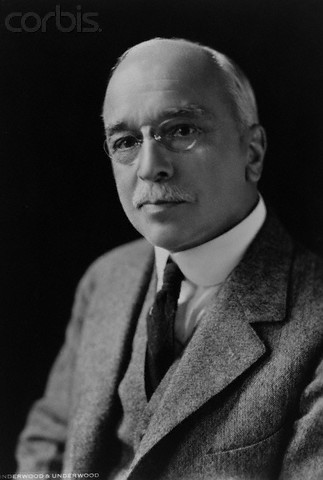

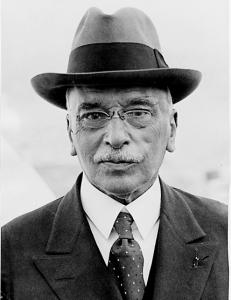

- Businessman and Philanthropist Edward Albert Filene, 1937

PAGE SPONSOR

Edward Albert Filene (September 3, 1860, Salem, Massachusetts - September 26, 1937, Paris, France) was an American businessman, social entrepreneur and philanthropist. He is best known for building the Filene's department store chain and for his decisive role in pioneering credit unions across the United States.

Edward was one of five children of William Filene (born: May 8, 1830) and Clara Ballin (born: December 13, 1833). William Filene was a German Jewish immigrant from Posen, Prussia, while Clara Ballin was born in Segnitz - am - Main, Bavaria. William immigrated to the US in 1848 after abandoning law school in Berlin. As “a peddler, chiefly of women’s apparel” he built up a company composed of several small retail shops and in 1881 founded a department store in Boston. It was some time in the 1850s that William and Clara met while Clara was visiting relatives in Hartford, Connecticut. They married in New York City.

At the age of 5 Edward was injured in a fall that left him with a permanent limp. In 1872, Clara Filene enrolled her three boys in Handel's Institut, a military school, known for excellence in instruction and discipline. The boys remained at the school until 1875, and was a period of intense loneliness and homesickness for Edward. Upon his return to the US, Edward attended high school in Lynn, Massachusetts, and worked in his father's store evenings, weekends, and summers. Edward passed his entrance exams for Harvard University but gave up his educational ambitions to take over the family business in 1890 when his father became seriously ill. One of the great disappointments in his life was being unable to attend Harvard.

Together with his younger brother Abraham Lincoln Filene, reorganized their father's store into William Filene's Sons Company, which would later become Filene's. In

1909, Edward established the "Automatic Bargin Basement" whereby unsold

merchandise moved from the floor to the basement as prices were

gradually reduced on a set schedule. Additionally, as goods remained

unsold, they were eventually donated to charity. Eventually, Edward was

ousted from store management, but retained an office and the title of

President. His ouster allowed him to dedicate more time to his passions

of travel, civic organizations, and philanthropy. Edward Filene drew inspiration from the scientific management ideas of Frederick Winslow Taylor.

While Taylor is best known for the use of scientific methods to

increase workplace efficiency, he was also interested in how to improve

the quality of work for employees. Filene is credited with refining a

number of under - utilized and some cases novel retailing techniques.

Filene’s Department Store offered complete and honest descriptions of

its merchandise and offered to give customers their "money back if not

satisfied". Although Filene's Basement was not the first ‘bargain basement’

in the United States, the retail design and later the ‘automatic mark -

downs’ generated excitement and proved very profitable. Filene

personally supervised construction of the first basement in Boston. An

advocate of consumer education, he introduced color matching tools in

the clothing departments of his stores. Filene was also a pioneer in employee relations. He instituted a profit sharing program, a minimum wage for

women, a 40 hour work week, health clinics and paid vacations. He also

played an important role in encouraging the Filene Cooperative

Association: ‘perhaps the earliest American company union’. Through this

channel he engaged constructively with his employees in collective bargaining and arbitration processes. He formed a savings and loan association for employees which later became the Filene Employee’s Credit Union. Filene “played a pivotal role in passing America’s first Workmen’s Compensation Law in 1911” and was a founder of the Boston, American and international chambers of commerce. Another

important initiative was the ‘Boston - 1915’, a multi - sector,

private - public sector partnership that organized leaders and committees

to take leadership roles in solving key urban problems, including slums,

public health, crime and local governance. Living in the era of Henry Ford,

Filene believed that the problems of mass production had essentially

been solved. But he feared that production by itself would not ensure

prosperity; if ordinary workers could not afford to continue financing

this expansion with their purchasing power, the result would be either

reduced production or worse, increased social inequality leading to

violence or dictatorship. He saw credit unions as an important part of

the answer. In a speech in California in 1936 he summed up his view. “What

is needed is that the American masses shall learn the art of

constructive self - government in this machine age – in this age in which

life is no longer organized on a small community pattern but in which

all Americans are more or less dependent upon what all other Americans

are doing.” Filene

also believed in the intrinsic capability of ordinary people to improve

their own condition, given “good information and the discipline to use

it effectively.” This

faith led not only to his involvement with credit unions, but to a

wider interest in research into critical social and economic trends.

This research, if clearly explained to the public, would advance the

causes of both democracy and peace. These views led him to found the

Twentieth Century Fund in 1919 (since renamed The Century Foundation). Filene’s

lifestyle and motivation for his philanthropic work was described by

Bergengren, who knew him for much of his adult life. “He

had a great distaste for material things, lived very modestly, never

owned an automobile and was scrupulously careful about small

expenditures, all because he felt that he was a trustee for the money

that he had earned and that the trustee-ship involved turning his

accumulations into the greatest possible disinterested public service.” Filene

began traveling in the 1880s, purchasing merchandise, studying business

practices, and increasingly examining how different societies were

organized and the problems they faced. He corresponded with a wide range

of leaders from Woodrow Wilson and Georges Clemenceau to Mahatma Gandhi and Vladimir Lenin. In 1907 Filene traveled around the world, and by February reached Calcutta, India. There, he visited some rural cooperative banks that had been promoted and funded by the British colonial government. On his return, he contacted his associate Franklin D. Roosevelt and suggested that a similar type of organization be promoted by the US government in the Philippines. He

realized that credit unions could help ordinary American workers to

access loans when they needed them without falling victim to usury. Equally important, workers could save their money so that when hard times hit, they were prepared. Subsequent to this trip the philanthropy he practiced, combined with the steady implementation efforts of his associate Roy Bergengren were

critical to the emergence of credit unions in the United States. He

also donated $1 million to the Consumers Distribution Corporation to

help them organize a national network of cooperative retail stores. In 1908, Filene and Massachusetts banking commissioner Pierre Jay, helped organize public hearings on creating credit union legislation in Massachusetts. The Massachusetts Credit Union Act of 1909 was the first comprehensive credit union law in the United States, and would serve as a model for the Federal Credit Union Act of 1934. Filene

seems to have been responsible, with the collaboration of Pierre Jay,

for the adoption of the term ‘credit union’ in the United States. His

concern with fighting loan sharks and

excessively costly consumer loans led to the choice of the word

‘credit’, while his interest in working people made him want to cast unions in a more positive light. Inspired

by the experience in many European countries where credit unions were

called ‘people’s banks’, Filene organized the National Association of

Peoples Banks to advance the credit union cause in the US. However,

little came of this until 1921, when Filene observed in Roy Bergengren

the key organizer he needed. Together with Bergengren he founded the

Credit Union National Extension Bureau. The Extension Bureau, to which

Filene donated nearly $1 million during its 14 year history, had four

goals: 1. to bring about the laws needed for credit union development in the various states, The collaboration between Filene and Bergengren,

and the work of the Extension Bureau, proved very effective. It brought

state laws to fruition in 26 states and substantially revised flawed

legal frameworks in 5 others. In 1934 the Roosevelt Administration passed the Federal Credit Union Act, making it possible to form a credit union anywhere in the United States. The Extension Bureau has been a model for many projects related to international development and microfinance since. Foreshadowing debates that still rage however, the views of Filene and Bergengren diverged on two key issues. First,

Bergengren believed that the Extension Bureau should attempt to secure

federal legislation first, rather than work state by state. Filene

prevailed in this debate, maintaining that a national law should be

based on a sound understanding of the diverse circumstances of people

across America -- from shrimp fishermen in Louisiana, to factory workers

in Massachusetts or farmers in the mid - West. Only by developing many

state laws first would such a sound national understanding be possible. Second, as the Great Depression set in the Reconstruction Finance Corporation under President Hoover sought

to stimulate the economy with soft loans targeted to banks, railways

and large companies. Filene favoured asking for $100 million in

reconstruction credits to be pumped into credit unions. Bergengren

strongly opposed this position, and his view prevailed this time. "To

him, it meant destroying the vital principle of the whole movement by

converting a community enterprise into an agency of the government. To

teach people how to help themselves was more important by far in times

of depression than at any other time." With the work of the Bureau essentially completed, a national meeting of credit union leaders was called at Estes Park, Colorado. On August 11th, 1934 the Credit Union National Association –

a national federation funded by the nation’s credit unions -- was

formed to replace the Bureau. The role of philanthropy in creating the

US credit union system was over. The founding By - Laws of CUNA recognize Filene’s contributions with the following words: “In grateful recognition of the fact that Edward A. Filene is the Raiffeisen of

America – that he first brought cooperative credit to the United States

– that he created in 1921 and financed from 1921 to 1934 the Credit

Union National Extension Bureau in order that there might be a sustained

development of cooperative credit in our country – in free

acknowledgement of the unique debt which we and succeeding generations

of credit union members owe and will always owe him – we make a part of

these our By - laws, not subject at any time to amendment, this

acknowledgement – and we create the office of Founder of this

Association and name Edward A. Filene to that office for life.

Thereafter said office shall be abolished." During the 1930s, Filene was concerned about the growing threat of the Axis powers on the international front, and the need to prevent another Great Depression on the home front. He was appalled by the growing strength of the Fascist movement and worried about the growing anti - Semitism in Europe. He gave many speeches on the subject and wrote against the growing anti - Semitism in the United States. His

other major concern was mass production. He argues that higher wages

and shorter hours for workers would enable them to buy materials they

could not otherwise afford. He wrote several books on the subject and

proposed that mass production, mass distribution and worker purchasing

power were the answer to economic depression. He admired the methods of Henry Ford in the auto industry. In 1935, he made a visit to Moscow and

was stricken with pneumonia. His assistant, Lillian Schoedler was able

to get him the best of care and he did recover. In 1937, however, he

made another trip to Europe to attend the International Chamber of

Commerce meeting in Paris. He again contracted pneumonia and died in

the American Hospital in Paris on September 26, 1937. His

death was reported on the front page of every major newspaper in the

world. A man who thought of himself as a “seller of pins” would have

been honored indeed by the tribute paid to him by President Franklin D.

Roosevelt when he heard of Filene’s death Roosevelt wrote: "It

is not individual persons but the people as a whole who were closest to

the heart of this unique personality. Mr. Filene was, however, more

than a champion of popular rights. He was a prophet who perceived the

true meaning of these changing times. He was an analyst who was able, by

mathematical calculations, to make plain to us that our modern

mechanism of abundance cannot be kept in operation unless the masses of

our people are enabled to live abundantly. His democracy was, therefore,

more than a tradition. His liberalism was more than a formula. His

faith was more than a mere assent to principles which have proved to be

tried and true. He did not repudiate the past, after the fashion of some

reformers, nor did he repudiate the future after the fashion of those

who fear reform. He believed in learning and searching out the ways of

human progress.” Roy

Bergengren conducted a series of memorial meetings for credit unionists

around the country. The Board of Directors of Credit Union National

Association and CUNA Mutual Insurance Company voted to raise funds to

build a memorial to their founder. Filene House in Madison, Wisconsin,

was the result. President Harry S. Truman dedicated the building in May 1950. An

additional memorial, the S.S. Edward A. Filene, a liberty class cargo

ship was built for the U.S. Maritime Commission in 1944. The hull number

was 2472 and built by St. Johns River Shipbuilding Company, Jacksonville, Florida.

The ship started construction on 9 February 1944 and launched on 6

April 1944, with a christening ceremony attended by many Floridian credit union people and Catherine Filene Shouse. The S.S. Edward A. Filene was sunk in 1966 at Cook Inlet, Alaska to be used as a breakwater and dock. Perhaps partly as a result of his childhood injury, and the eczema that

plagued him throughout his life, Filene was shy as a youth, and never

married. As several writers mention, this may be why “his family in a

very real sense became society as a whole.” The

results of this dedication speak for themselves. By the end of 2008 US

credit unions had 89 million members. This is the largest membership of

any country in the world, and one of the highest levels of market

penetration in the world. A credit union think tank and research organization, the Filene Research Institute, is named in his honor as the father of the credit union movement. A building of the Hillman Housing Corporation, a housing cooperative in the Lower East Side of Manhattan, is named after him. Bronze busts honoring Filene and seven other industry magnates stand outside between the Chicago River and the Merchandise Mart in downtown Chicago, Illinois. The first credit union to be named after Filene outside the United States was Filene Credit Union in Broad Cove, Nova Scotia, in December 1932.

2. subsequently, to organize some credit unions in each state that could serve as examples to others,

3. to expand the number of credit unions to the point that they could create self - sustaining state federations, and

4. to combine the federations into a self - sustaining national association.