<Back to Index>

- Astronomer Michael Maestlin, 1550

- Pedagogue and Writer Stanisław (Hieronim) Konarski, 1700

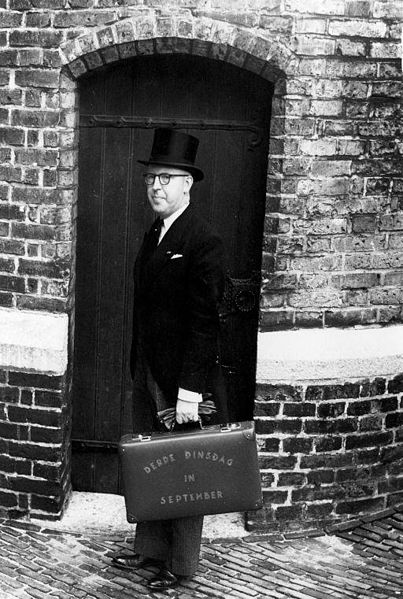

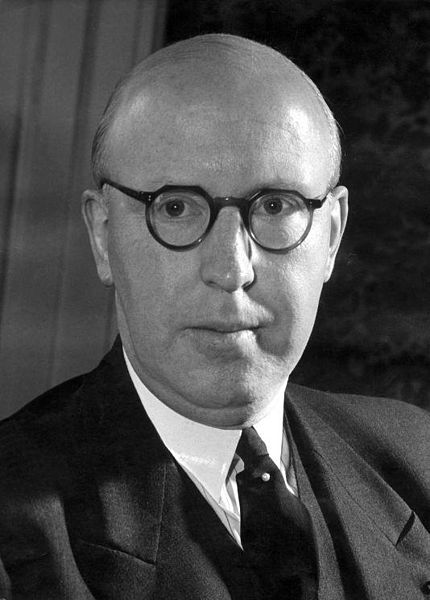

- Minister of Finance Pieter (Piet) Lieftinck, 1902

PAGE SPONSOR

Pieter (Piet) Lieftinck (Muiden, September 30 1902 – The Hague, July 9 1989) was a Dutch civil servant, chief executive, professor and politician. He became minister of Finance in the following administrations Schermerhorn / Drees (1945 - 1946), Beel-1 (1946 - 1948), Drees / Van Schaik (1948 - 1951) and Drees-2 (1951 - 1952). In this function, he was largely responsible for the monetary recovery of the country and its currency.

Lieftinck became professor at the Erasmus University Rotterdam at a relatively young age. Before the second world war, he supported the left wing of the Protestant Christian Democrats (CHU). In 1945, he joined NVB, which failed in the elections of 1946. In 1946, he moved to the socialist party (PvdA) and in 1971 he joined the moderate leftist DS'70 party.

From May 1942, he was a prominent hostage in the Sint - Michielsgestel prison camp (the former minor seminary of Beekvliet). He worked with other politicians on ideas of a new political constellation after the second world war in the breakthrough committee.

In June 1945, Lieftinck became the first post war minister of Finance of the Netherlands. He inherited a deeply troubled economy. A third of the national assets were destroyed. The infrastructure was greatly damaged in war action. Rotterdam was destroyed, practically all the large bridges were damaged and some large polders had been flooded. On top of that, the Allies demanded an expeditionary Royal Netherlands Army to fight in the Pacific.

The disastrous situation in the economy was further threatened by a sick financial economy. The government in exile had taken the gold reserves to London and had, to a significant degree, spent them. In the Netherlands, exports of money, goods and services to nazi Germany were credited to a Reichsmark account in Berlin that was, of course, never paid. The government budget was in heavy deficit, which was financed by printing money. The Dutch guilder was linked to the Reichsmark at the fixed rate of 1.327. In this way, the value of the Dutch guilder was completely linked to that of the Reichsmark and in 1945 the Reichsmark was not worth anything. These circumstances fulfilled all the conditions for an outbreak of hyperinflation: the money supply had quadrupled from 2.5 billion gulden to 10.9 billion guilder while the supply of goods was only a fraction of what it had been.

The new minister of Finance started by withdrawing the 100 guilder note in July 1945. Those holding notes were given a blocked bank credit. This note had been the subject of distrust anyway and many were held by war profiteers. On 25 September 1945 it was announced that as of the next day all banknotes were withdrawn and all bank credits frozen. All paper cash handed in gave rise to a credit on a blocked bank account. For one week, until 2 October 1945 there was no valid paper money in the country with a single exception. Everyone with a distribution card could change ten guilder in withdrawn notes for new money. This action was known as Lieftinck's tenner. Significantly, although the amount was small, it was enough for a week.

In the week of 26 September 1945, banks were supplied with new banknotes, so that people could receive their wages. In the following months, de-blocking started. On 19 September 1946 a special tax was levied on any positive difference in assets between May 1940 and December 1945. Tax rates went from 50 to 70% and 90% for unexplained profits, largely to hit profiteers. An additional tax on liquid assets was introduced on 11 July 1946. Rates went from 4 to 20%. This last measure came in for especially heavy criticism.

The operation of “financial sanitation” was a great success. The money supply was halved and inflation was kept on a reasonable level. This set the stage for meeting American demands to qualify for Marshall aid. Profiteers had helped to finance reparations of war damage. A great degree of leveling of wealth had occurred and the economy had been put on a new and sound footing; both points had been high on the wish list of the Beekvliet reformers.

Lieftinck introduced a new coinage law in

1948, abrogating gold standard coins. In the same

year, he moved a new banking law through parliament.

He retired as minister in 1952, but from 1955, he was chief executive officer of the World Bank and the International Monetary Fund. After

retirement, he remained active as an advisor to

successive Dutch and Surinam governments

on matters of economic and financial reform.