<Back to Index>

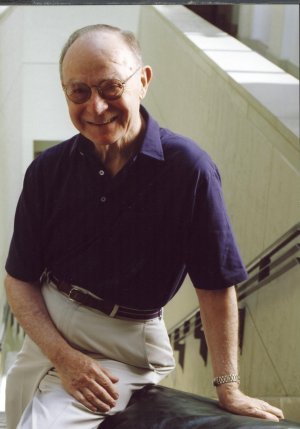

- Economist Allan H. Meltzer, 1928

PAGE SPONSOR

Allan H. Meltzer (February 6, 1928 - May 8, 2017) was an American economist and professor of Political Economy at Carnegie Mellon University's Tepper School of Business in Pittsburgh, Pennsylvania. He was born February 6, 1928, in Boston, Massachusetts. He was the author of dozens of academic papers and books on monetary policy and the Federal Reserve Bank, and was considered one of the world's foremost experts on the development and applications of monetary policy.

Meltzer's study A History of the Federal Reserve is considered the most comprehensive history of the central bank. Volume II, which covers the years since the Federal Reserve accord in 1951 to 1969, was released in February, 2010.

Meltzer was considered to have originated the

aphorism, "Capitalism without failure is like religion

without sin. It doesn't work."

Allan Meltzer received his A.B. and M.A. degrees from Duke University in 1948 and 1955, respectively. He earned his Ph.D. degree from UCLA in 1958.

Dr. Meltzer served, from 1973 to 1999, as the Chair of the Shadow Open Market Committee, a group of economists, academics, and bankers that met to critique the actions of the Federal Reserve's Federal Open Market Committee. He served on the Council of Economic Advisors for both Presidents Kennedy and Reagan. He was a visiting scholar at the American Enterprise Institute.

Dr. Meltzer was the Chairman of the International Financial Institution Advisory Commission, known as the Meltzer Commission. The Commission's majority report proposed changes to the operations of the International Monetary Fund and especially to those of the World Bank, which the majority recommended should withdraw from lending to "middle income countries". Four (out of 5) Commission members nominated by the then minority Congressional Democrats filed a dissent from the majority's recommendations (Bergsten, Huber, Levinson and Torres), though one of the four (Huber) both voted for the majority report and joined the dissent. The official vote tally in favor was thus recorded as 8 to 3. Controversy over the majority's arguments and recommendations continued after the report's publication: the majority's core recommendations are defended by Chairman Meltzer's chief advisor Adam Lerrick, and challenged by one of the Commission's critics (David de Ferranti), in their respective chapters in an edited volume published by the Center for Global Development.

Dr. Meltzer was the first ever recipient of the AEI's Irving Kristol award in 2003. Dr. Meltzer was honored at the award dinner by President George W. Bush, who remarked "I know I'm not the featured speaker; I'm just a warm-up act for Allan Meltzer."

Dr. Meltzer was highly critical of the Federal Reserve's September 2008 decision to rescue the leading bond insurer AIG: "these disasters should be headed off early, or should be left to the marketplace to settle." Consistent with this position, the Fed's decision not to rescue Lehman Brothers was one which, at the time, Dr. Meltzer appeared to applaud. Contrasting it with the AIG rescue, he commented: "I would say we ought to look at Lehman Brothers. They let Lehman Brothers fail. Within a few days, just a few days, Barclays was there buying up some of Lehman's assets..." A year later, however, Dr. Meltzer took a more critical view of the Fed's handling of the Lehman case: "After 30 years of bailing out almost all large financial firms, the Fed made the horrendous mistake of changing its policy in the midst of a recession... Allowing Lehman to fail without warning is one of the worst blunders in Federal Reserve history... "

Dr. Meltzer opposed US adoption of a "cap and trade" scheme for carbon emissions, designed to help combat global climate change.